I don’t know why this topic grabs my attention the way it does. Maybe it’s because I’ve been quietly fascinated by how we pay for things ever since contactless cards appeared. Or maybe it goes back even further to this tech show I watched years ago. It was probably the early 2000s, maybe even before that, and they were covering a guy in Singapore who tried to spend an entire day using only a watch that was linked to the local payment system. It was a test for the show, and he actually pulled it off. He managed to buy food, travel around, and live his normal routine without touching his wallet once. I thought that was the coolest thing.

So when tap to pay and mobile wallets finally arrived, I was ready. It felt like the future was catching up. But over time, I’ve learned that not all of these systems deserve to exist. Some work beautifully. Others are so clumsy they make you nostalgic for exact change.

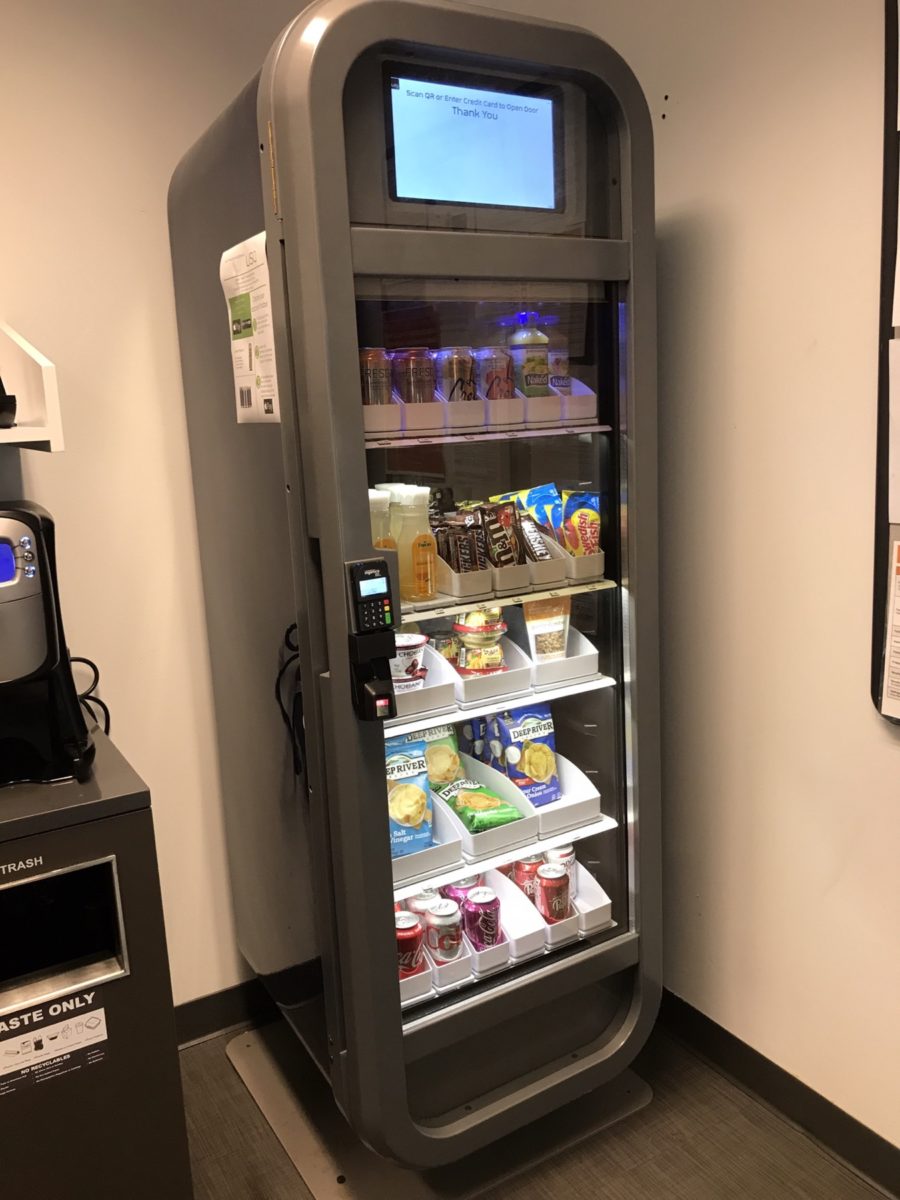

I’ve written before about those “Please Take My Money” moments, the times when businesses make it weirdly difficult for customers to give them money. This is in that same spirit, just focused on the modern point of sale experience, or really the broader world of how we’re expected to pay for things now. Some places get it right. Others seem to treat usability like a design flaw.

And that’s how we arrive at GBK, Gourmet Burger Kitchen, which manages to turn something simple into a mild endurance test.

GBK: The Anti Convenience Experience

GBK lets you order at the counter or through their app. In theory, that’s flexible. In practice, it’s annoying. When I’m sitting at a table, I don’t want to get up and stand in line like I’m at McDonald’s. GBK isn’t supposed to be that kind of place.

We’ve been to the Stratford location several times, and every time it’s the same story. Between my wife’s Three network, my EE connection, and even my work phone on a different provider, none of us can get a decent signal inside. So you try their free Wi Fi, which of course wants a bunch of personal details before letting you in. It’s not free. It’s just data collection in disguise.

Once you’re connected, the app insists that you register. You can’t just use Apple Pay or Google Pay. You have to create an account, fill in your billing details, and basically hand over your life story before you can order a burger. The irony is that the whole point of tap to pay systems was to skip that kind of nonsense. But GBK wants your information, not your convenience.

After fighting with the app a few times, we gave up and just started ordering at the counter again. The food’s fine, good even, but the ordering system makes the experience harder than it needs to be. It’s like they built a digital wall between customers and the register.

The Bigger Problem

This isn’t just about GBK. It’s about how so many modern payment systems have completely missed the point. They were supposed to make life easier, but in too many cases, they’ve turned into data traps or loyalty funnels. The best systems disappear into the background. You pay, and that’s it. No account, no registration, no email sign up, no exclusive offers. Just pay and eat.

GBK gets a fail from me. I’ll keep writing about more of these experiences because some places do get it right, and others, well, not even close.

So yes, GBK, please take my money. Just stop making me work so hard for it.