It’s time for another round of Please Take My Money, the ongoing saga of payment systems that either make it ridiculously easy to spend money or somehow turn it into a test of patience and willpower.

Today’s contestant: Green King.

When I think back, I don’t even remember Green King having an online payment system before COVID. Maybe they did, but it certainly wasn’t memorable. Then lockdown happened, and suddenly the idea of ordering from your phone became not just convenient, but essential.

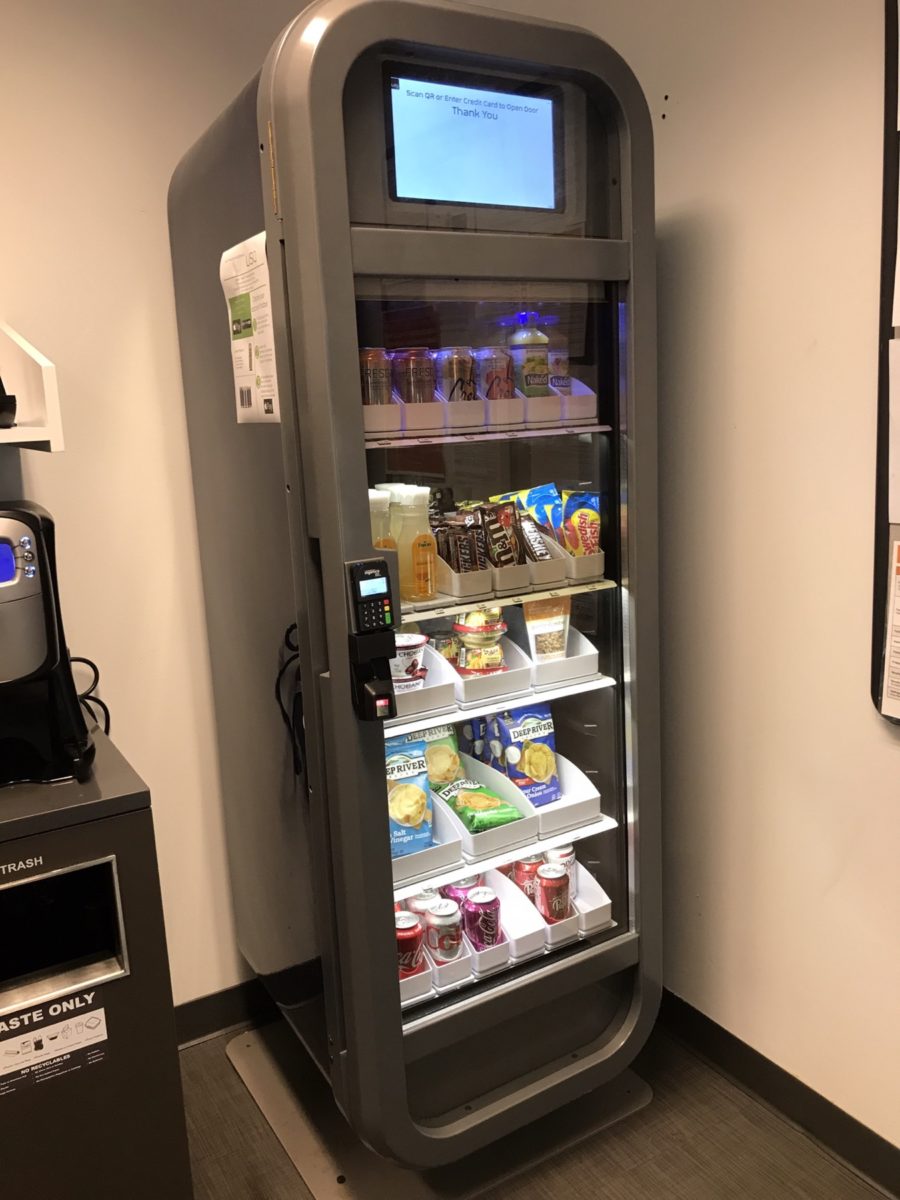

After restrictions lifted, one of the first places we went was our local Green King pub. For the first time, they had an online ordering option. I actually thought that was great. One thing the pandemic got right, if we can say that about anything, is the ability to order food and drinks from your table instead of waiting in line at the bar.

Now, don’t get me wrong, I like the charm of a proper English pub. I don’t mind going up to order a drink. But queuing to order food? Hard pass. So the fact that Green King introduced mobile ordering felt like progress.

Originally you had to register for an account. Nothing kills “convenience” faster than “please create a password.” I get that companies want to collect data and “build loyalty,” but if you’re in the business of selling me a sandwich and a beer, maybe focus on that. I don’t need another account to forget about.

Anyway, once I begrudgingly registered, it worked fine. I could order food, add my table number, and my meal magically appeared without waiting at the bar. That alone put Green King ahead of some others I’ve tried. So let’s call the early days a neutral: annoying sign-up, but decent execution.

Fast forward a few years, and they’ve clearly learned. The app no longer requires you to store your card details. You can just pay with Apple Pay or Google Pay and be done. No extra forms, no saved card nonsense, no trust fall into yet another company’s database.

And that’s the thing. Retailers love to say they “take security seriously.” The reality is that they may not be able to focus on it as deeply as a credit card company or a bank does, which is understandable. So when an app lets me not store my card details, that’s a feature, not an inconvenience. It’s basically zero knowledge in practice. If they ever get hacked, it won’t matter, because my card details were never there to steal in the first place.

These days, ordering through Green King’s app is smooth. You tap, pay, and your order’s on its way. Seamless. Efficient. Almost enjoyable.

So, after a rocky start, Green King has graduated from “barely tolerable” to “actually pretty great.” They finally figured out the assignment: make it easy for me to give you my money.